You set the goal, we’ll guide the way.

We’ve used a few different building blocks in the make up of our portfolios. Invest in a portfolio which is uniquely put together with a combination of these to deliver on a specific investment goal, or select the blocks you’d like to invest in, in whatever combination suits your style.

Our paths are plotted using algorithms which determine optimal portfolios for investors based on their risk preference; whether conservative, moderate, or aggressive.

We use a combination of active and passive investing to stay the course, while still being responsive to market conditions. Our passive investment strategy follows a rules-based and data-driven approach. On the active side of our portfolio construction, we analyze the risk factors that affect a company’s operating structure and stock performance.

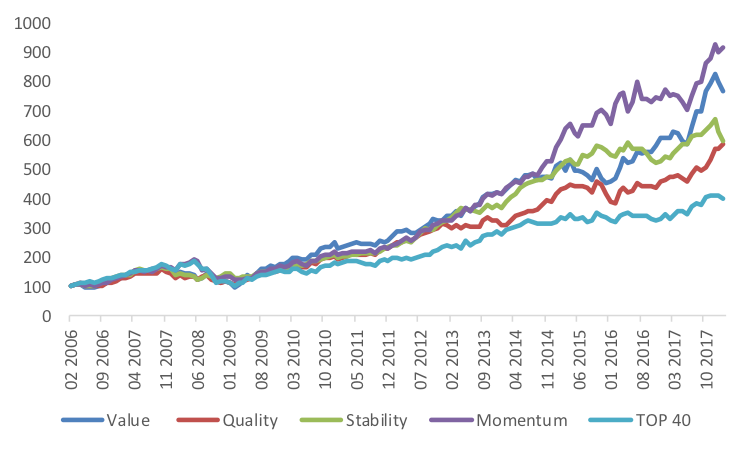

We’ve used 5 different building blocks as the guiding principles to shape our portfolios. Each portfolio is uniquely put together with a combination of Value, Quality, Stability and Momentum styles to deliver on a specific investment goal, taking into account the associated risks. You can also invest in these blocks on their own, or in a combination that suits your investment style.

It takes a team. And as the experts who’ll be steering your investment journey, we want you to be able to learn along the way. Transparency and education are key drivers in leading the expedition.

Our Building Blocks

The intrepid adventurer knows that it doesn’t take just one skill to conquer a mountain. Different abilities and traits will need to be drawn on at different times to achieve the task at hand. This is why we’ve used a few different building blocks in the make up of our portfolios. Each one is uniquely put together with a combination of the below to deliver on a specific investment goal, taking into account the associated risks.

Value

We use a variety of indicators to determine which companies are trading at a discount to their fair value and hence fit into our Value building block. These include multiples such as price-to-earnings and free cash flow yield, which commonly indicate the likelihood of a company reverting to its mean after large market dislocations that push prices away from fair value.

Quality

Our Quality building block is focused on profitable companies that deliver consistent earnings and so provide a margin of safety over time. Dividends play a vital role in determining a company’s quality, and we use our proprietary dividend-weighting methodology to construct the Quality building block.

Stability

The Stability building block comprises companies that exhibit lower volatility. Such companies, all around the world, tend to outperform the broader market at a lower risk. Emperor’s Stability building block portfolio invests in companies whose volatility is measured over periods of both one and three years.

Momentum

For the Momentum building block, we look at both price momentum and price revisions. This entails investing in companies that have a strong past performance, as well as those that demonstrate strong forward earnings or sales momentum. These factors are strongly correlated. Emperor’s Momentum building block selects companies based on their price momentum over six months and one year, weighting them according to our proprietary momentum “ z score”.

This graph shows the total back-tested returns of Emperor’s building block portfolios. We can recreate this performance simply by applying our rules-based methodology over different time frames.

What’s your risk number? Calculate now

Take our risk evaluation tool and understand your risk profile.

Get to know our team

The Emperor Asset Management team comprises a highly skilled, widely experienced group of focused financial experts whose success in generating products and wealth in the investment arena has been proven over a significant period of time.